Apple Pay Later

Apple Pay Later.

Easily pay over time.

No interest. No fees.1 No surprises.

Built-in tools to keep you on top of your spending.

Designed with privacy and security in mind.

Pay with

Apple Pay,

manage in Wallet.

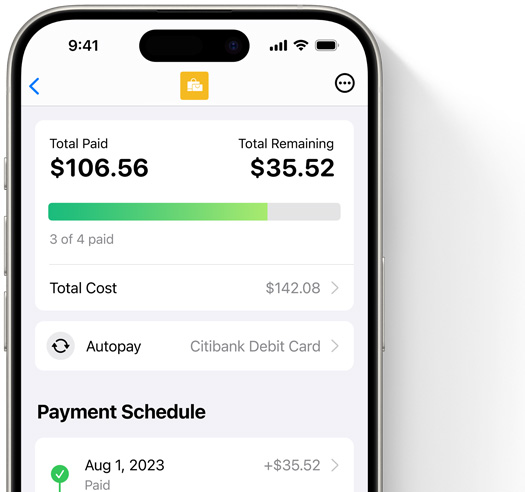

Shop freely, buy responsibly. Apple Pay Later splits your purchases into four equal payments over six weeks — with no fees or interest.2 Use it on the millions of apps and websites that accept Apple Pay to more easily buy the things you want. You can use it for purchases between $75 and $1000 made on iPhone and iPad.

Apply quickly and seamlessly at checkout. It’s easy to use Apple Pay Later. Simply choose Apple Pay at checkout when you shop online or in apps, then tap the Pay Later tab to start your application. No additional apps to download, no extra passwords needed. You can apply with no impact to your credit score, and you’ll know in moments if you’re approved.3

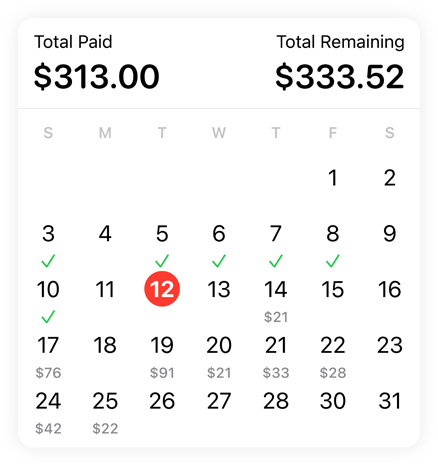

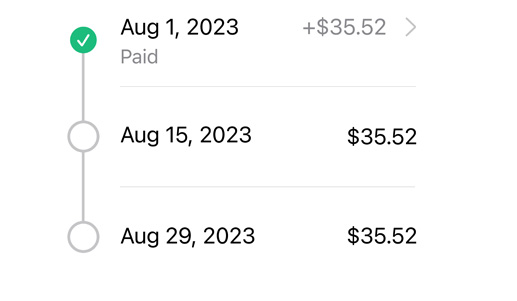

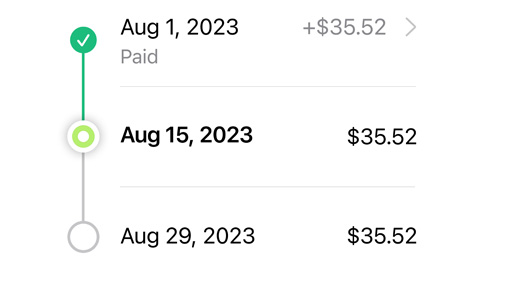

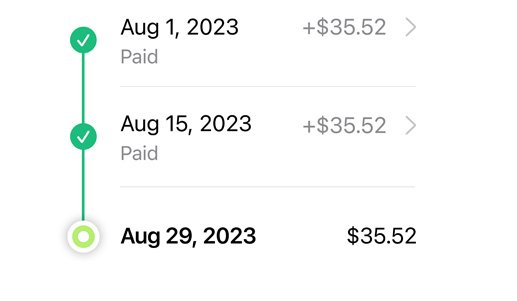

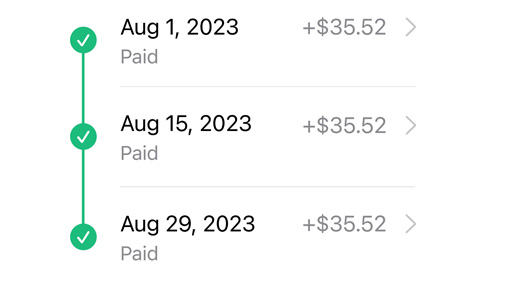

How to useGet a clear picture for payments. Before you buy, you’ll see your four new payments alongside your other upcoming Apple Pay Later payments. So you have a good look at your commitments, before you commit. Use autopay to make payments, or choose to pay manually at any time. As due dates approach, you get alerts and reminders to help you plan ahead. And you can access all your payment information in Wallet.

How to manage payments

Easy like Apple Pay. Apple Pay Later is a feature of Apple Pay — giving you the same simple, secure, and seamless shopping experience that Apple Pay is known for.

What you buy is your business. Apple doesn’t share or sell your spending history, loan details, and credit information to merchants or marketers.

Security against fraudsters. Powerful security features like Face ID, Touch ID, and a passcode help ensure that you’re the only one making an Apple Pay Later purchase on your iPhone or iPad.

Support on tap. Apple Pay Later Specialists are here whenever you need them. Reach out via Messages or a quick phone call, whichever you prefer.

How to get help

Protection from unauthorized purchases.

You can report a suspicious transaction just as you would with a credit card. It’s easy to do in just a few taps from Wallet.

To use Apple Pay Later, you must:

Apple Pay Later is available with Apple Pay in apps and online, on iPhone or iPad.2 Just tap the Apple Pay button at checkout and tap the Pay Later tab to get started.

Apple Pay Later is available with Apple Pay in apps and online, on iPhone or iPad. The merchant you shop with must be located in the United States. If you don’t see the option to use Apple Pay Later

You pay no interest or fees, including no late fees.1

When you apply, a soft credit check is performed that does not impact your credit score. Your Apple Pay Later loan and payment history will be shared with one of the major credit bureaus after you complete a purchase. Your credit score won’t currently be affected, but it may be in the future. Learn more

Eligible merchants in the United States that accept Apple Pay online and in apps are automatically set up to accept Apple Pay Later — no integration work required. For more details about the merchant experience, visit Apple Pay Later for Developers.

Apple Pay Later is available with Apple Pay for purchases between $75 and $1000 made on iPhone or iPad on most websites and apps that accept Apple Pay.